Paradoxically, even though bitcoin is considered to be a new evolutionary phase for finance, its high volatility prevents it from acting as actual money. Stablecoins are commonly seen as a solution to the problem, by adding market price stability to the equation.

However, not every stablecoin follows the commandments of Satoshi Nakamoto. Some stablecoins are regular e-monies, somewhat like PayPal transplanted onto the blockchain. They have very little in common with the ideology behind bitcoin, being downright centralized.

This post will take a look at the difference between centralized and decentralized stablecoins, which will help us understand why the latter is so crucial for the success of DeFi.

Centralized stablecoins: main features

They are tokens running on public blockchains that are claimed to be fully backed by national currencies with their underlying fiat currency reserve being stored in banks or other financial institutions. This means that they are not cryptocurrencies but rather banks accounts wrapped as such. The issuers of these centralized stablecoins can freeze coins or refuse to redeem them at their own discretion or following an order from a regulator.

On top of that, there is no real guarantee that the stablecoin is indeed fully backed with a 1:1 national fiat currency reserve. For instance, one may discover that one of the most popular stablecoin in the cryptocurrency ecosystem is actually only partially backed as, according to the media, its issuer opted to use a part of the backing to help out one of its partners.

Today, almost all centralized stablecoins are pegged to the U.S. dollar. USDT, USDC, TUSD, PAX, and GUSD account for nearly 95% of the supply and trading volume of the stablecoin market.

With the exception of USDT, most centralized stablecoins are ERC-20 tokens running on Ethereum. This is good and bad at the same time since on the one hand, it might be risky to keep all stablecoins on the same blockchain and on the other hand, it allows one to easily use them in the DeFi ecosystem that is most active on Ethereum.

Decentralized stablecoins: main features

We already talked about decentralized stablecoins before and the way you could use them for leverage. Now let’s talk about how they work.

The main difference between decentralized stablecoins and their centralized peers is that the former don’t use bank accounts for the underlying, while retaining the connection with national fiat currencies as a unit of account. In fact, there are contracts for difference backed with cryptocurrency, such as DAI. Simply put, the issuer of a decentralized stablecoin undertakes to redeem it with $1 worth of cryptocurrency.

This obligation is backed with the issuer’s cryptocurrency which is usually deposited in a smart contract. If something goes wrong, you are still able to redeem your tokens at the price of $1 per token. This is basically how emergency shutdown works in MakerDAO, the issuer of DAI.

While centralized stablecoins are banks wrapped as cryptocurrencies, decentralized stablecoins are volatile cryptocurrency wrapped in a stable cryptocurrency.

Diversity of decentralized stablecoins

DAI so far appears to be the only successful decentralized stablecoin today. It has enjoyed adoption by many DeFi apps and some people even go as far as to call MakerDAO the central bank of Ethereum.

However, the diversity of possible designs of decentralized stablecoins doesn’t go down to DAI alone. For instance, AEUR by Augmint is pegged to Euro and backed by ETH, and SUSD by Syntetix is pegged to USD and backed by SNX.

Terra uses its own blockchain where one can create different stablecoins pegged to different anchors. Those stablecoins would be backed by LUNA, the Terra network coin which also represents Terra mining power. Like Ethereum, Terra supports decentralized finance apps but uses DPoS instead of PoW.

Non-Collateralized stablecoins

Also called algorithmic stablecoins, this special kind of stablecoins are not backed by any reserve. Economically speaking, the idea is similar to fiat being managed by a system of smart contracts strictly following a transparent monetary policy rather than central banks. The theory is that if national monetary authorities manage to maintain a stable exchange rate in money that is not backed by tangible assets, a smart contract could work just as successfully.

Non-collateralized stablecoins are the least researched type of stablecoins. Currently, there are no projects that appear to have successfully implemented this model. If you are interested to learn more, take a look at NuBits, Basis, and Ampleforth.

Which kind of stablecoins is better after all?

The main advantage of decentralized stablecoins is that they are trustless and require no intermediaries for issuance, circulation, and redemption.

Conversely, the main advantage of centralized stablecoins is that they are supposedly backed by a national fiat currency stored by a regulated financial institution rather than by a volatile cryptocurrency in a smart contract that can be hacked or faulty.

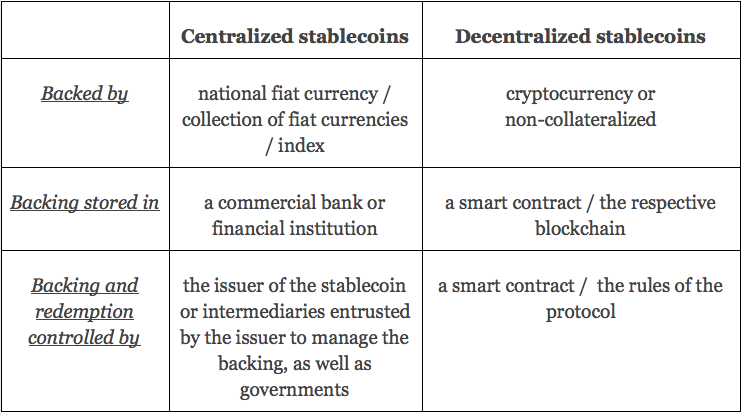

Here’s a brief summary of their features.

It’s up to you to decide which fits your purposes best.

Conclusion

DeFi cannot be truly decentralized without decentralized money. Decentralized stablecoins are an experiment in making a bitcoin-like cryptocurrency with a stable exchange rate, and DeFi created a major impetus for such experiments. It is way more important in terms of monetary history than transplanting USD onto the blockchain.

However, the cryptocurrency ecosystem connects with the traditional economy through the exchange of crypto for fiat. And it is worth remembering that national currencies exist on blockchain as decentralized stablecoins, thus dollars on the blockchain also matter.